Marlborough Ma Real Estate Taxes . marlboro county online tax payment. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. town of marlborough: Property values by location fy 2021; Property values by location fy 2022; There is a $99,999.00 max limit on all credit card. the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. 24 rows present & past tax rates; tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. 140 main street, ofc 4.

from ownit-ma.com

140 main street, ofc 4. There is a $99,999.00 max limit on all credit card. marlboro county online tax payment. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. 24 rows present & past tax rates; the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Property values by location fy 2022; Property values by location fy 2021; town of marlborough:

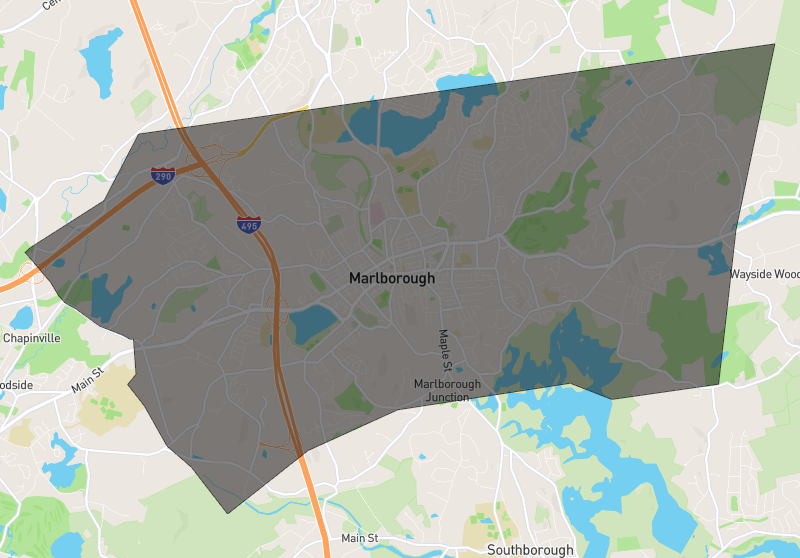

Homes for sale in Marlborough MA Real Estate Available OWN IT MA

Marlborough Ma Real Estate Taxes Property values by location fy 2022; the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. 24 rows present & past tax rates; the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. town of marlborough: There is a $99,999.00 max limit on all credit card. Property values by location fy 2022; 140 main street, ofc 4. Property values by location fy 2021; marlboro county online tax payment. tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes 140 main street, ofc 4. the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. town of marlborough: Property values by location fy 2021; Property values by location fy 2022; tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes 140 main street, ofc 4. marlboro county online tax payment. Property values by location fy 2022; tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes marlboro county online tax payment. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. 140 main street, ofc 4. Property values by location fy 2021; . Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes Property values by location fy 2021; Property values by location fy 2022; marlboro county online tax payment. town of marlborough: the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes town of marlborough: 140 main street, ofc 4. There is a $99,999.00 max limit on all credit card. marlboro county online tax payment. Property values by location fy 2021; 24 rows present & past tax rates; the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. Property values. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes There is a $99,999.00 max limit on all credit card. marlboro county online tax payment. the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. 140 main street, ofc 4. Property values by location fy 2022; tax bills (real estate, personal property, and motor vehicle. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes marlboro county online tax payment. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. 140 main street, ofc 4. tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. the city of marlborough tax assessor. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. There is a $99,999.00 max limit on all credit card. the marlborough city council on monday set. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes 140 main street, ofc 4. marlboro county online tax payment. Property values by location fy 2021; tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. . Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. marlboro county online tax payment. Property values by location fy 2021; the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. town of marlborough: tax bills. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes Property values by location fy 2021; the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. town of marlborough: marlboro county online tax payment. the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes There is a $99,999.00 max limit on all credit card. the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. town of marlborough: Property values by location fy 2021; the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. 140 main street, ofc 4. town of marlborough: tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. There is a $99,999.00 max limit. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. 24 rows present & past tax rates; marlboro county online tax payment. There is a $99,999.00 max limit on all credit card. Property values by location fy 2021; town of marlborough: the city. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes town of marlborough: the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. 140 main street, ofc 4. There is a $99,999.00 max limit on all credit card. the city of marlborough tax assessor is responsible for setting property tax rates and collecting owed property. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes Property values by location fy 2021; There is a $99,999.00 max limit on all credit card. 24 rows present & past tax rates; town of marlborough: marlboro county online tax payment. the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. the marlborough city council on monday. Marlborough Ma Real Estate Taxes.

From ownit-ma.com

Homes for sale in Marlborough MA Real Estate Available OWN IT MA Marlborough Ma Real Estate Taxes the city of marlborough tax assessor's office oversees the appraisal and assessment of properties as well as the. town of marlborough: 140 main street, ofc 4. the marlborough city council on monday set the 2022 tax rates at $13.12 per $1,000 for residential properties and $22.17 for commercial,. tax bills (real estate, personal property, and motor. Marlborough Ma Real Estate Taxes.

From www.realtor.com

Marlborough, MA Real Estate Marlborough Homes for Sale Marlborough Ma Real Estate Taxes tax bills (real estate, personal property, and motor vehicle and excise) may be mailed to the collectors office at 140 main street,. Property values by location fy 2022; Property values by location fy 2021; 140 main street, ofc 4. marlboro county online tax payment. town of marlborough: the marlborough city council on monday set the 2022. Marlborough Ma Real Estate Taxes.